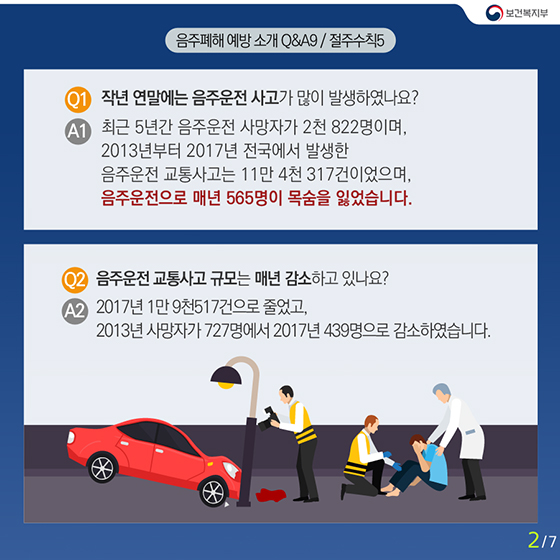

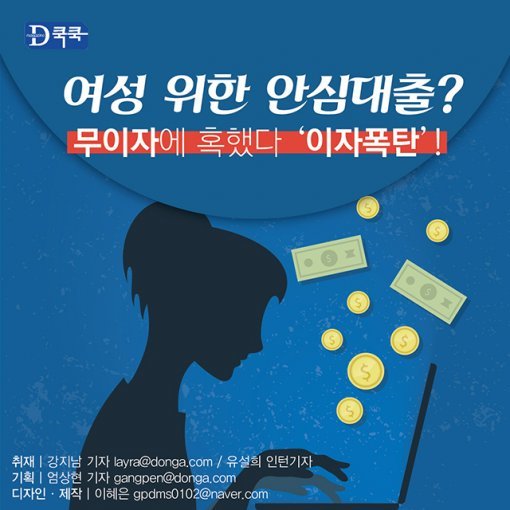

To make a decision without risk, we need to know about women’s loans

If your annual income is about 22 million won and you need less than 5 million won in cash that you can lend right away, what would you do if you suddenly need 10 million won? Or what should I do if I can’t pay back because I’m facing difficulties related to money even though I have about 80 million won in loans?? You may be at a loss just imagining it, but you don’t have to judge this as an insurmountable problem. Necessary money can be borrowed from financial institutions, and debts that cannot be held accountable can be resolved through workouts. However, such a solution requires a premise that you should study common sense in loans properly, so we will explain these financial information and help you make effective judgments according to each person’s environment.

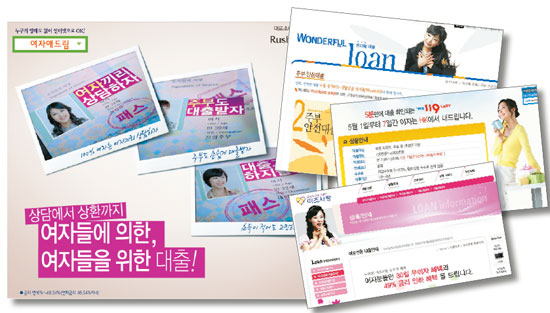

.jpg)

I would like to inform you about women’s loans that are easy to understand from the basic content.

Since each financial institution has different products and benefits, more detailed information will be explained sequentially next time, so this article only mentions important information. First of all, the first financial sector such as Woori Bank and Citibank is legally protected and interest rates are low, but compared to ordinary benchmarks, the loan limit is 75% of annual income, and the average interest rate is 4.38% based on 740 credit points. In the case of the second financial sector, which includes securities firms, general financial firms, and insurance companies, the average limit exceeds 115%, which is measured more relaxed than banks, but the interest rate is close to 12.91%. For that reason, it is advantageous in the long run to visit the banking sector if you have a good credit rating, but if you get a lot of money with more than 3 loan products or less than 575 points of credit, it is best to use the second financial sector.

Information on easy-to-use loans for women with commodities for the common people

However, there are government-sponsored loans for those who have low credit ratings and have difficulty in financing or have poor repayment ability despite a shortage of cash, and it is typical to approve them at low interest rates for those with low credit ratings such as Hessal Loan or Hessal Loan Use. These products can be repaid within 3 to 10 years at a low interest rate of 5.40%, and even if the credit rating is not good, they can be used easily, so various people use them when the current status of funds is not good.

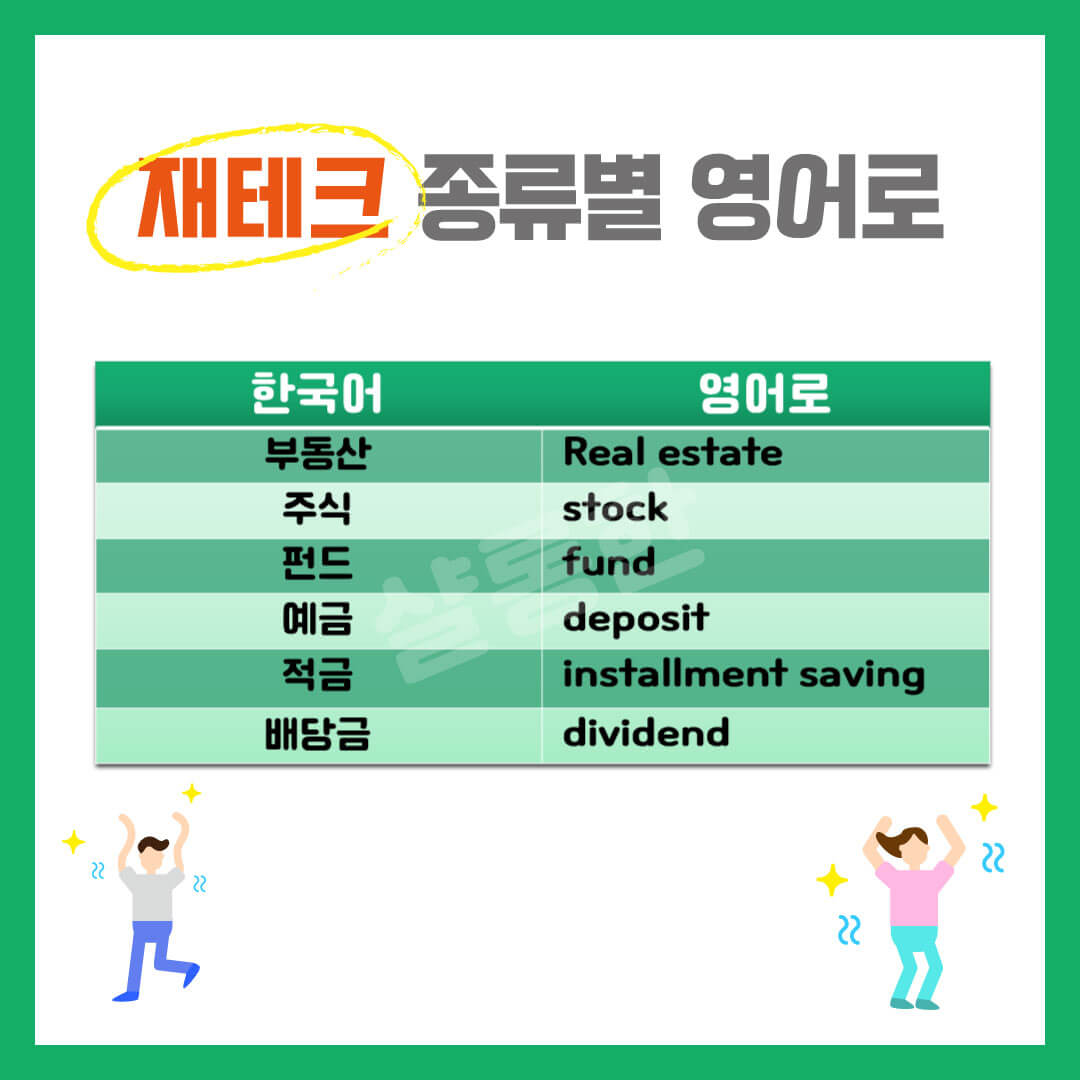

We must also understand the harmony between investment and the financial sector.For those looking for women’s loans

In addition, the popularity of financial technology has increased due to the increasing number of financial channels that can use a small amount of money, but collateral loans differ by 45% in the ratio of mortgage loans by location such as overheated speculation, adjustment, and non-adjustment. However, since the limit is measured by housing prices for collateral purposes, it is necessary to carefully compare the increase in housing prices with real estate policies. In addition, there are cases where credit loans are used to obtain about 18 million won and join stock investment to generate returns exceeding the 5.5% interest rate, but risks may exist depending on the market economy, so you should calculate them steadily and make reasonable adjustments.

For those who are investigating women’s loans that need to be used according to their conditions

As the utilization rate of financial institutions increases, property can be easily increased by using loan products in a smart way in a modern society where attention has been focused on unearned income and financial technology. However, it can be easily lost if you approach it, so you have to get an appropriate loan according to the purpose of use, and if you take the loan wisely, it will be 63% cheaper, the monthly repayment will be about 550,000 won, and real estate mortgage loans will be 3.76% cheaper and 1.45 million won cheaper. We have informed you of the benefits of the unknown common people and financial products, so please check them carefully and use them to your advantage when you need to lend a large amount of money.

Previous image Next image

Previous image Next image

Previous image Next image